ENG

MNE

The subject of VAT - includes all necessary adjustments in Business Central, in order to obtain official (legal) reports that must be prepared on a monthly basis for the needs of the Tax Administration (KIF, KUF, VAT return).

In the search engine, you need to type VAT Statements:

U okviru pretraživača potrebno je ukucati Izvodi PDV - a:

- Within the VAT Statement, for the creation of a VAT return, it is necessary to assign a specific VAT category to each change (indicate the tax category code)

U okviru Izvoda PDV - a za formiranje PDV prijave potrebno je svakoj promeni dodeliti određenu kategoriju Pdv - a (navodi šifru kategorije poreza)

For each change, it is necessary to set the General type of posting depending on the transaction type Sales or Purchase:

Za svaku promenu potrebno je podesiti Opštu vrstu knjiženja u zavisnosti koju predstavlja vrstu transakcije Prodaju ili Nabavku:

The amount types of columns determines whether the VAT statement row shows VAT amounts or base amounts on which VAT is calculated

Kolona vrsta iznosa određuje da li red izvoda PDV-a prikazuje iznose PDV-a ili iznose osnovice na koje se obračunava PDV.

Row Addition column - specifies a row number interval or a series of row numbers.

Kolona Sabiranje redova - određuje interval broja reda ili niz brojeva redova.

2. U okviru Izvoda Pdv - a potrebno je podesiti drugi tip izveštaja - KUF

Klikom na ... možemo izabrati izveštaj:

The procedure is similar to that of the VAT application, each line of the VAT Statement must be assigned a VAT Identifier (Indicates the VAT identifier code that was chosen for grouping different VAT posting settings with similar attributes)

Postupak je sličan kao kod Pdv prijave, svakom redu Izvoda Pdv - a potrebno je dodeliti Indentifikator za PDV (Navodi šifru identifikatora za PDV koja je izabrana za grupisanje različitih podešavanja knjiženja za PDV sa sličnim atributima)

It is necessary to set the General type of posting (at KUF, it is procurement) and Type of amount (depending on whether it includes the amount of VAT or the basis)

Potrebno je podesiti Opštu vrstu knjiženja (kod KUF - a je u pitanju nabavka) i Vrsta iznosa (u zavisnosti da li obuhvata iznos Pdv - a ili osnovicu)

Within Row Addition, it is necessary to include a series of row numbers:

U okviru Sabiranja redova potrebno je obuhvatiti niz brojeva redova:

3. Within the VAT Statement, it is necessary to set another type of report - KIF The procedure is similar to that of the VAT application, each line of the VAT Statement must be assigned a VAT Identifier (Indicates the VAT identifier code that was chosen for grouping different VAT posting settings with similar attributes)

3. U okviru Izvoda Pdv - a potrebno je podesiti drugi tip izveštaja - KIF

Postupak je sličan kao kod Pdv prijave, svakom redu Izvoda Pdv - a potrebno je dodeliti Indentifikator za PDV (Navodi šifru identifikatora za PDV koja je izabrana za grupisanje različitih podešavanja knjiženja za PDV sa sličnim atributima)

It is necessary to set the General type of posting (at KUF it is a sale) and Type of amount (depending on whether it includes the amount of VAT or the basis)

Within Row Addition, it is necessary to include a series of row numbers:

U okviru Sabiranja redova potrebno je obuhvatiti niz brojeva redova:

In the browser, we type Setting up posting for VAT:

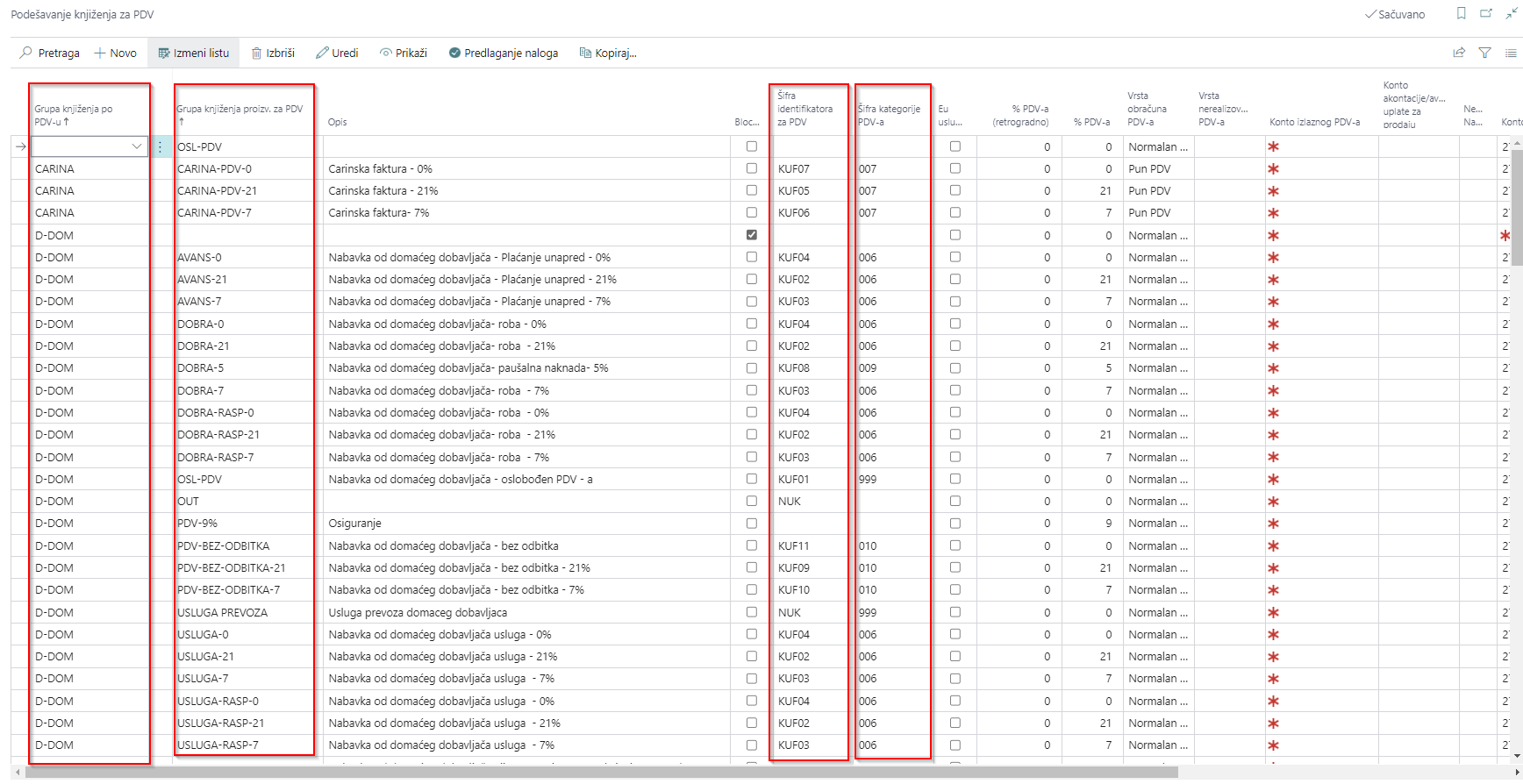

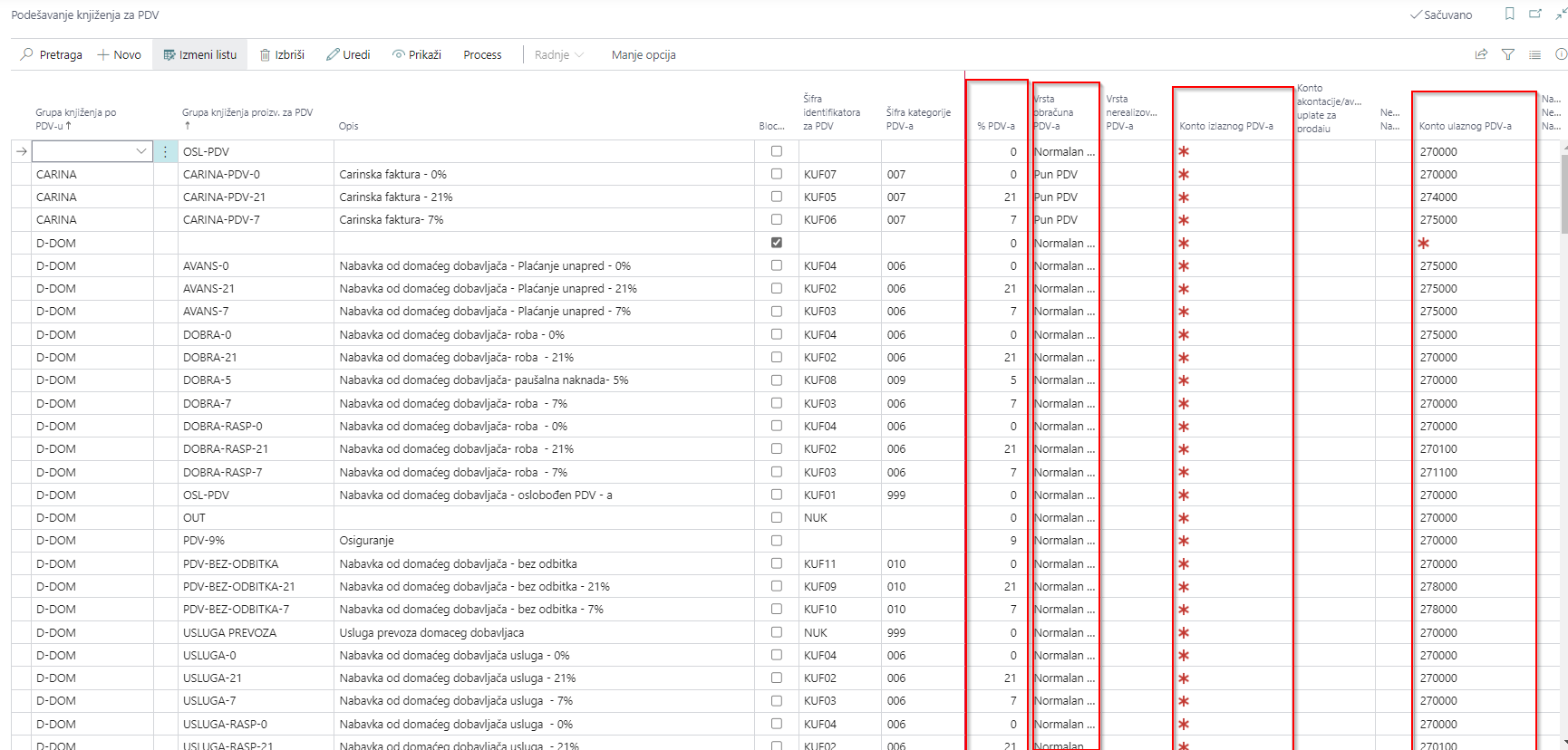

- VAT Posting Group - specifies the VAT specification of the involved customer or supplier to link the transactions made for this record to the corresponding general ledger account according to the VAT posting setup.

- Posting group prod. for VAT - specifies the VAT specification of the included item or resource to link the transactions made for this record to the corresponding general ledger accounts according to the VAT posting setup.

- VAT identifier code

- VAT category code

- VAT % - specifies the appropriate VAT rate for a specific combination of a VAT posting business group and a VAT product posting group. Do not enter a percent sign, just a number.

- Output VAT account - specifies the general ledger account number to which output VAT is posted for a specific combination of VAT posting business group and VAT product posting group.

- Input VAT account - specifies the general ledger account number to which input VAT is posted for a specific combination of business group and product group.

VAT REGISTRATION REPORTS, KIF, KUF

IZVEŠTAJI PDV PRIJAVA, KIF, KUF

In the browser, we type VAT application:

U pretraživaču kucamo Prijava Pdv - a:

Potrebno je kreirati period Pdv - a:

By clicking on VAT settlement, we will get the result of all three reports:

Klikom na namirenje PDV - a dobićemo izled sva tri izveštaja:

VAT report:

Izveštaj PDV - a:

KUF report:

KUF izveštaj:

KIF report: